Schedule a Call Back

May-24 IIP received manufacturing boost to 5.91%

Industry News

Industry News- Jul 15,24

Related Stories

Devendra Fadnavis inaugurates advanced drone manufacturing facility in Nagpur

Building on the success of Nagastra-1, the facility is advancing the development of Nagastra-2 and Nagastra-3 under the ‘Make 2’ initiative.

Read more

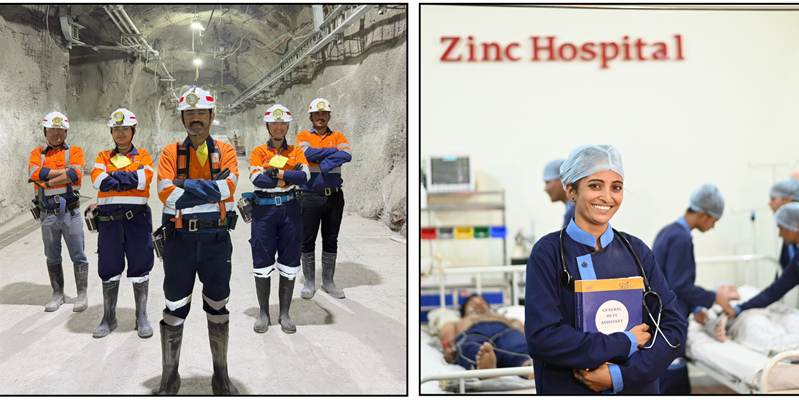

Hindustan Zinc reaffirms commitment to youth empowerment on National Youth Day

Hindustan Zinc’s skill development based social impact initiative has successfully trained nearly 8,000 rural youth by equipping them with market-relevant skills.

Read more

Gainwell unveils India’s first indigenous room and pillar mining equipment

Coal currently accounts for approximately 56% of India’s primary commercial energy demand, with coal-based power generation contributing 72% to total electricity production.

Read more