Schedule a Call Back

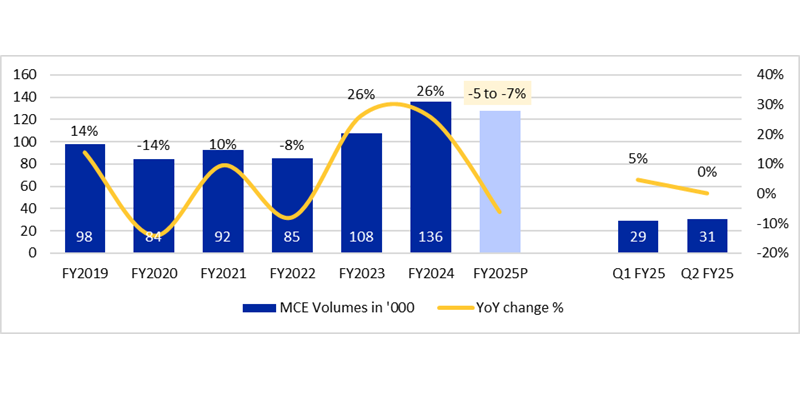

Sales of Indian MCE industry to fall by 5-7% in FY2025: ICRA

Industry News

Industry News- Oct 17,24

Related Stories

Punjab to Open 200 New Mining Sites to Curb Illegal Extraction

Legal mineral supply to exceed demand from March

Read more

Hi-Tech Pipes Starts Commercial Output at Kathua Plant

New Jammu unit boosts capacity and strengthens northern market reach

Read more

EV transition and tariff wars redefine India’s auto components play

India’s auto component industry is poised to hit $ 145 billion by FY30 from $ 80 billion in FY25. Yet high US tariff, EV transition and heavy reliance on imports from China expose vulnerabilities,..

Read moreRelated Products

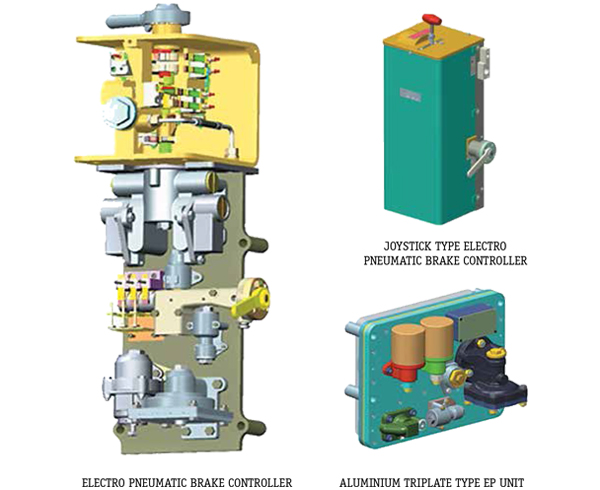

Electro - Pneumatic Brake System for Emu

Escorts Kubota Limited offers a wide range of electro - pneumatic brake system for EMU.

Indef Powered Crane Kit

Hercules Hoists Ltd offers a wide range of Indef powered crane kit.

Jib Crane

DC Hoist & Instruments Pvt Ltd offers a wide range of Jib crane.