Schedule a Call Back

Boiler: Powering India’s growth story

Communication Feature

Communication Feature- May 01,19

Related Stories

Atlas Copco unveils modular steam rental solutions at Boiler India Expo 2024

Their compact design ensures easy installation and rapid commissioning, minimising downtime and providing a reliable steam supply.

Read more

Thermax partners with Ceres for large-scale green hydrogen production in India

The partnership aims to accelerate the adoption of SOEC technology in India and globally, enhancing green hydrogen production.

Read more

Thermax scouts for a new green hydrogen partner

This is because a planned venture with Australian green energy firm Fortescue Future Industries (FFI) to develop green hydrogen projects in India did not materialise.

Read moreRelated Products

Coil Type Boilers - VRS Series

Maxima Boilers Private Limited offers a wide range of coil type boilers - VRS Series

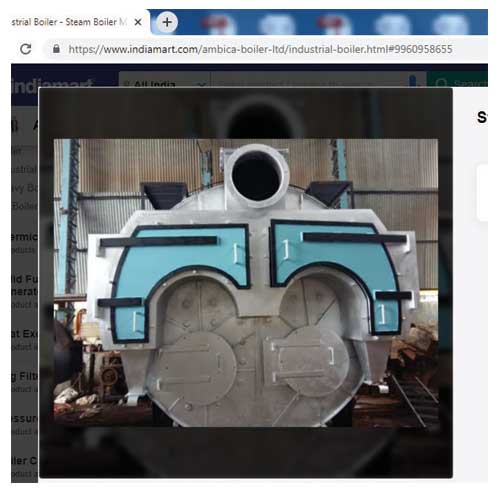

Steam Boiler

Ambica Boiler offers a wide range of steam boiler.

Flash Tanks

<p>Tecor Boilers Pvt Ltd offers a wide range of flash tanks.</p><div><br></div> Read more