Schedule a Call Back

India Resurgence Fund to acquire Anthea Aromatics for $125 million

Industry News

Industry News- Nov 13,24

Related Stories

India Resurgence Fund to acquire Anthea Aromatics for $125 million

IndiaRF, which raised its inaugural $629 million fund with contributions from the Canada Pension Plan Investment Board (CPPIB) and World Bank’s IFC, invests across industrial, infrastructure, and ..

Read more

Bain Capital to invest in auto component maker RSB Transmissions

Bain Capital, a multi-asset alternative investment firm, invests across various asset classes, including private equity, credit, public equity, venture capital, real estate, life sciences, and insur..

Read more

Solar charging infrastructure will push green mobility, suggests Dr Aanchal Jain

PMI Electro Mobility is a leading electric bus manufacturer in the country. The company aims to garner fresh orders under the recently announced PM e-bus Sewa scheme. This will greatly enhance PMI E..

Read moreRelated Products

Programmable Controllers - Pcd-33a Series

Pro-Med Instruments (P) Ltd offers a wide range of programmable controllers - PCD-33A Series.

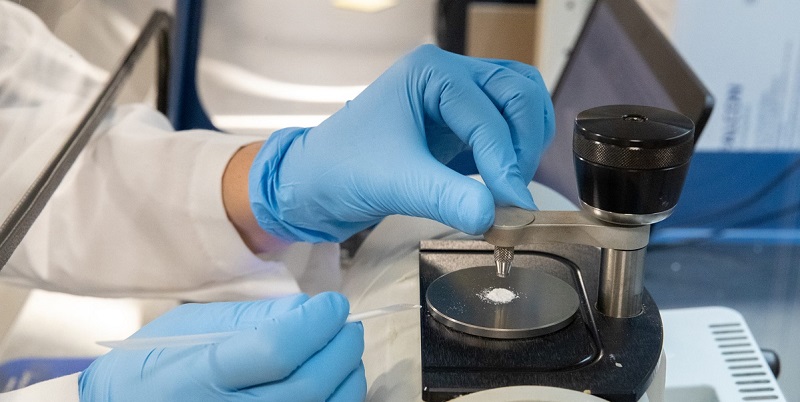

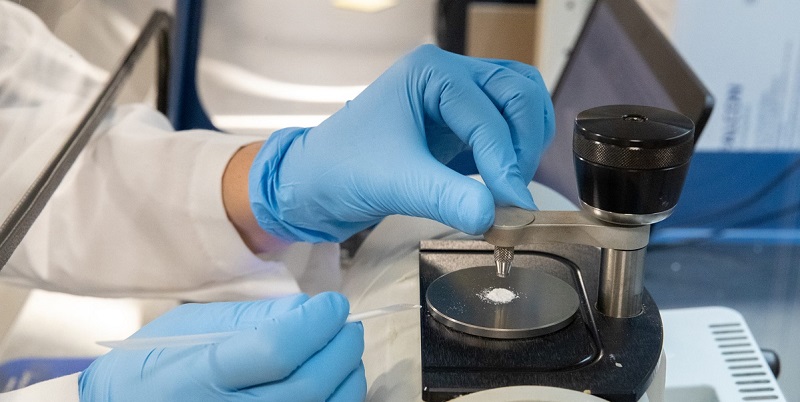

Gasket Graphite Powder

Arihant Packing & Gasket Company offers a wide range of gasket graphite powder.

Asahi Kasei expands 3D printing filament sales in North America

Asahi Kasei, a leading resin and compounding technology provider, has initiated the sales of 3D printing (3DP) filaments in North America through Asahi Kasei Plastics North America (APNA). The soft la Read more