Schedule a Call Back

A rundown of the global battery recycling market

Articles

Articles- Jul 27,24

Related Stories

Lithium-ion battery storage: India’s import dependency to fall to 20% by FY27

The GoI has taken initiatives on several demand-side measures, such as Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme, Viability Gap Funding (VGF) scheme for Battery Energy Sto..

Read more

Innovative technologies in motion control attract new entrants to the market

Although new vendors have not acquired meaningful market share, as the supplier base has not yet consolidated, we expect they will increase their presence, especially in their local markets; China, ..

Read more

Global battery manufacturing equipment market to reach $30 billion by 2029

Despite a somewhat pessimistic forecast for market revenue, demand from all regions continues to drive the battery equipment market.

Read moreRelated Products

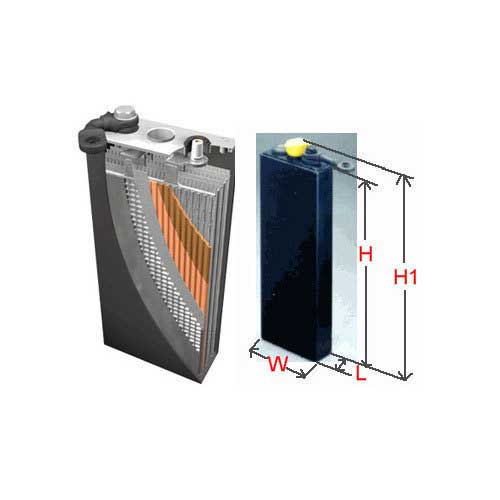

Forklift Battery

Aatous International is a manufacturer and solution provider of a wide range of forklift battery.

Wrist Type High Voltage Alarm

‘KUSAM-MECO’ has introduced a new wrist Type High Voltage Alarm Detector - Model KM-HVW-289 having a wide sensing range from 1kV-220 kV AC.

Servotech Power Systems files 2 patents for energy management technologies

Servotech Power Systems, a leading manufacturer of EV chargers and solar solutions, has announced that it has filed two patents for innovative energy management technologies in order to facilitate gri Read more