Schedule a Call Back

India EV market competition grows: Bloomberg report

Articles

Articles- Feb 26,25

Related Stories

India EV market competition grows: Bloomberg report

While growing demand and intensifying competition are driving several automakers to fund their expansion plans via the public markets.

Read more

Texmaco Rail and Nevomo Partner to create new era of rail infrastructure

This alliance aims to redefine the rail industry by co-developing and implementing Nevomo’s cutting-edge Magrail technology and Linear Propulsion Systems along with related technology solutions.

Read more

Operational EVs in India to cross 28 million units in 2030; IESA

According to the report, the total installed capacity (of India) is required to grow from 466 GW in January 2025 to 900 GW by 2032.

Read moreRelated Products

Tata Motors unveils facilities for development of Hydrogen propulsion tech

Tata Motors, India?s largest automobile company, unveiled two state-of-the-art & new-age R&D facilities for meeting its mission of offering sustainable mobility solutions. The unveilings constitute of Read more

Tata Motors plans petrol powertrain for Harrier and Safari SUVs

Tata Motors is in the process of developing a new petrol powertrain for its premium sports utility vehicles, the Harrier and Safari, as confirmed by a senior company official. Currently, these models Read more

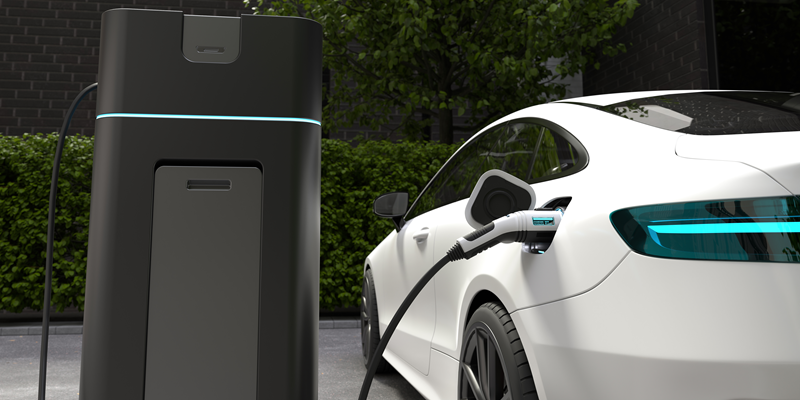

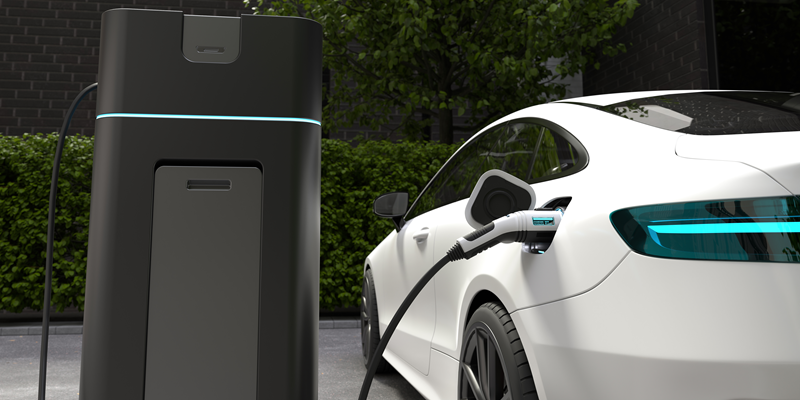

Electric Vehicle Charger

RRT Electro is engaged in manufacturing of customized Power Electronic Products over two decades having capability to Design, Develop, Prototyping, Regulatory Compliance testing & Certification, Manuf Read more