Schedule a Call Back

Slow local demand & sluggish export growth heavily affect Chinese manufacturing

Articles

Articles- Jun 11,24

China's manufacturing industry is facing a challenging period marked by sluggish growth, influenced by a dip in consumer spending, an on-going housing market crisis, and a trend towards nearshoring driven by the US 'decoupling' from the Chinese supply chain, says Samantha Mou, Interact Analysis.

China’s manufacturing industry has been undergoing a difficult period, leading to sluggish growth. A dip in the growth of consumer spending, an ongoing housing market crisis, and a trend towards nearshoring, led by the US ‘decoupling’ from the Chinese supply chain, are continuing to constrain growth. This has led Interact Analysis to make a small downwards revision in its forecast growth for China’s manufacturing output during 2024 compared with last quarter’s prediction, from 2.8% to 2.4%.

Interact Analysis’ Manufacturing Industry Output (MIO) Tracker is published every quarter and provides a crucial insight into the fast-moving manufacturing sector. The report covers over 102 industries and sub-industries, across 45 countries, and presents 15 years of historical data with a 5-year forecast.

To gain a better understanding of the outlook for Chinese manufacturing, domestic demand and exports during 2024 and into 2025, we interviewed Interact Analysis Research Analyst Samantha Mou.

What has changed in the last quarter and how has this affected the projection for China?

We have revised down the year-on-year growth of China’s MIO value in 2023. Last year is now the lowest point of growth in our latest forecast for China MIO, as the metals and non-metallic minerals sectors turned out to be affected more seriously than expected by the real estate downturn.

We expect China’s manufacturing to perform better in 2024 than in 2023, supported by a recovery in exports and new orders. Strong performance of the US economy has also improved our outlook for global demand this year. However, the continued slump in China’s property sector and weak recovery in consumer confidence are major challenges impacting our projections for 2024. Therefore, our prediction for China’s year-on-year manufacturing output growth in 2024 has been adjusted down slightly, from 2.6% to 2.4%.

What is the outlook for the domestic market in China?

The recovery in domestic demand remained sluggish as of May 2024, and this has led to intensive competition and price decreases in the domestic market in China. Deflationary pressures have been prevalent in China’s manufacturing sector since the beginning of last year, and the pricing factor is likely to remain a drag on manufacturing output growth in China this year. As of April 2024, China’s Producer Price Index (PPI) has fallen by more than 2% year-on-year for 13 consecutive months.

The manufacturing Purchasing Managers’ Index (PMI) in China returned to growth (above 50) in March and April, but due to the continued weakness in the property sector, we do not expect China’s domestic demand to improve significantly before the second half of 2024. Among industrial sectors, we have observed positive signs of recovery in the semiconductor industry, but investments and production in the EV sector have been cooling down compared to last year.

What is the outlook for Chinese exports?

In 2023, China’s total exports of goods fell by 4.6% in US dollars, but the decline has been narrowing in the second half of the year. In the first four months of 2024, China’s export value returned to growth, increased by 1.5% from the same period last year. Exports are recovering more quickly than domestic demand in China. Indications of resilience in both the US economy and global demand have improved our outlook for Chinese exports.

In China’s export structure, labor-intensive products are losing out to products with higher added value. In past four years, production of apparels, plastic products and toys in China’s total exports declined, while automobiles (especially electric vehicles), electrical equipment and general-purpose machinery increased.

In 2024, we expect China’s electric vehicle exports to continue to grow faster than China’s total exports. However, the growth rate is likely to be lower than last year due to demand cycles and tariffs for Chinese EV exports.

How is consumer demand impacting China’s manufacturing industry?

On the consumer side, recent data indicates growth of domestic consumption in China continues to be weak. China’s Consumer Price Index (CPI) growth has been below 1% for more than a year (since February 2023). The property slump has been a significant factor in lowering consumer confidence. Because a large part of Chinese households’ wealth is in property, falling house prices have made consumers feel poorer and tend to save more.

Weak demand in the market has caused manufacturers to reduce prices due to competition and investment growth has also slowed because of reduced demand for capacity expansion.

This has triggered concern among international companies in China, with some cautious about expanding investment in China due to intensive price competition with local suppliers.

How is the global economic climate affecting China’s manufacturing growth? Are wider global issues having an impact?

The impact of the global economic climate on China’s manufacturing industry is primarily through its impact on China’s exports. Some economic factors that have substantial impacts in some regions – such as inflation and labor shortages – are not currently the main influencing factors in China’s manufacturing industry.

The US’ ‘decoupling’ with the Chinese supply chain is having notable impacts on China’s manufacturing industry, as some related companies are relocating or duplicating supply chains outside of China. US investment funds have also become cautious about investing in China. In the first months of 2024, China’s exports to the US continued to decline further, having fallen by 13% in 2023.

Recently, Europe has been discussing potentially increasing tariffs on Chinese products (e.g. EVs). If this takes place, it will also potentially affect China’s exports to Europe. Some Chinese manufacturers are setting up factories outside of China to avoid the possible impact of such policies. For example, Chinese EV manufacturer BYD is considering building a second factory in Europe.

When is a recovery likely to take place and what conditions will drive it? What could hamper China’s manufacturing recovery?

We expect the year-on-year growth of China’s MIO value in 2024 to be 2.4%, a slight increase from the growth registered in 2023 (2.0%).

As for industrial sectors, the semiconductor sector is expected to experience strong recovery in 2024, based on indications of a cyclical recovery in global demand for semiconductors, and the reported strong growth in orders from manufacturers. Compared to our projections in the last edition of the MIO, the electronics and electrical equipment industry saw the biggest increase in its forecast for 2024 growth, from 3.7% to 5.1%, due to anticipated improvements in export demand.

However, the continued slump in the property sector in China and the weak recovery in consumer confidence are expected to hamper China’s manufacturing recovery. Affected by the weak housing market, we anticipate the decline in China’s MIO value in 2024 to be most pronounced in the non-metallic minerals and off-highway commercial vehicle industries.

Compared with the end-products manufacturing segment, the machinery segment is expected to grow slightly faster in 2024. This is because, after a poor year in 2023, China’s manufacturing capacity utilisation rate shows signs of stabilising and manufacturers may once again consider investing in equipment (such as material handling machinery) to improve production efficiency.

Related Stories

Why is Workmen Compensation Insurance Essential for Both Employers & Employees?

A well-designed workmen compensation insurance plan helps employers stay legally compliant while providing vital support to employees during unexpected events.

Read more

ARAPL Order Book Grows Over 16 per cent Year on Year, Exceeding Rs 1.40 Bn

In the first half of FY26, ARAPL executed orders worth Rs 0.426 billion, reinforcing its operational scalability and execution capabilities.

Read more

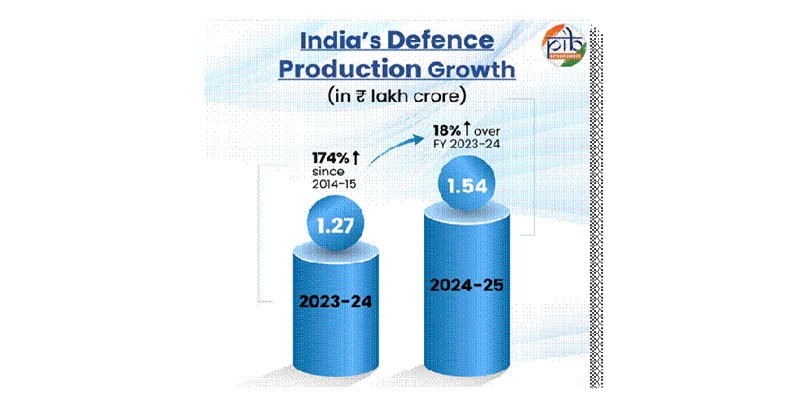

India’s Defence Production Hits Rs 1.27 Trillion, Driven by Reforms

Record output reflects decade of policy reforms, rising exports and strong domestic industry.

Read moreRelated Products

Fanless Industrial Pc for Smart Manufacturing

CONTEC Launches BX-M4600 Series - Fanless Industrial PC for Smart Manufacturing.