Schedule a Call Back

Budget 2024 to boost India’s manufacturing industry

Articles

Articles- Jul 30,24

Related Stories

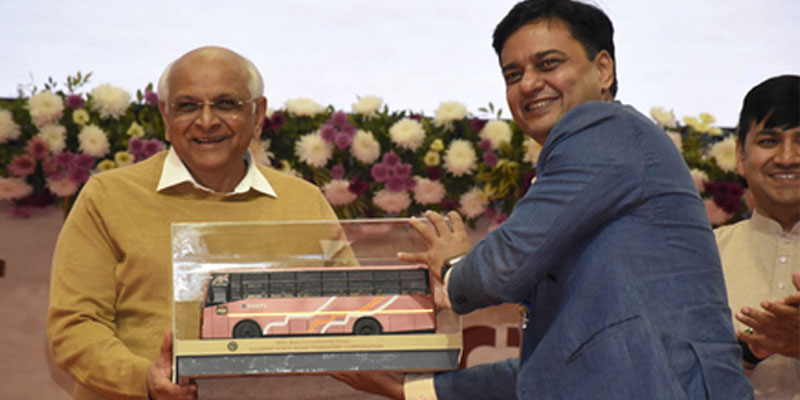

Ashok Leyland opens green mobility-focused greenfield plant in Uttar Pradesh

Designed primarily for electric vehicle manufacturing, the plant has an annual production capacity of up to 5,000 vehicles.

Read more

Vibrant Kutch Programme Secures Rs 85bn in MSME MoUs

District event boosts investment and growth in Gujarat’s Kutch

Read more

KJSIM Hosts MSME Programme on Quality and Exports

Five-day MDP equips entrepreneurs for global markets

Read more