Schedule a Call Back

AI on the edge will transform the shop floor: Sameer Gandhi

Articles

Articles- Dec 01,25

India’s manufacturing sector is undergoing rapid transformation as companies adopt automation, digitalisation and AI-driven systems. OMRON is supporting this shift through advanced technologies, application engineering and capability-building for both large enterprises and MSMEs, says Sameer Gandhi, Managing Director, OMRON Automation Pvt Ltd. In this interview with Rakesh Rao, he elaborates on trends and opportunities as the manufacturing sector opts for data-led decision-making, quality and safety.

Could you begin by outlining OMRON’s business in India?

OMRON Corporation - founded in 1933 in Kyoto (Japan) - has grown into a global technology leader driven by innovation. Today, the company operates across five major business domains, with Factory Automation (FA) being the largest, accounting for nearly half of OMRON’s global revenue.

I lead the FA business in India, based in Bengaluru. Beyond commercial growth, I view our purpose as contributing meaningfully to the advancement of India’s manufacturing sector. Our goal is to help Indian manufacturers become globally competitive by enabling them with cutting-edge automation technologies.

In India, the FA business largely follows an import–stock–sell model. While we do not manufacture FA products locally at present, OMRON has begun taking steps towards ‘Make in India’. The first milestone is our upcoming healthcare devices manufacturing facility near Chennai, marking the first phase of our localisation journey.

What products and solutions does OMRON offer in the Indian market?

Our offering in India mirrors the full global factory automation portfolio. It is one of the widest ranges of automation products available in the industry today—from relays to robots. We categorise our portfolio as ILOR+S:

- I (Input): Sensors, vision systems, X-ray inspection systems, IO-Link enabled smart sensors, devices for predictive maintenance, panel components such as relays and power supplies, etc.

- L (Logic): A complete PLC range—from micro to high-capacity PLCs, as well as controllers designed to integrate OT and IT layers. Our recently launched DX1 controller provides low-code/no-code capability to bridge shop-floor and enterprise systems.

- O (Output): Servo drives and motors.

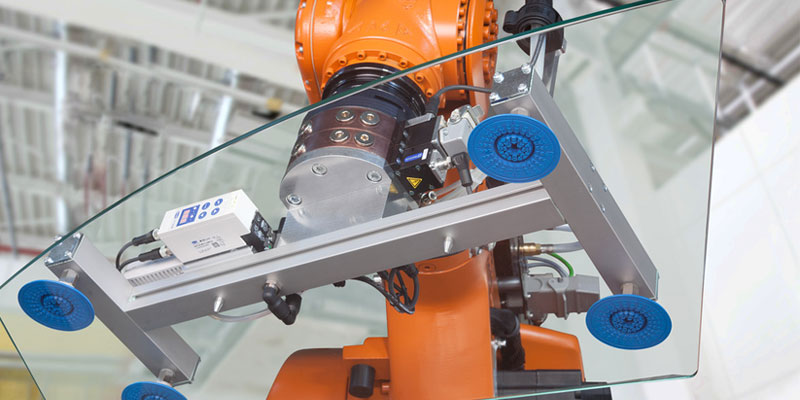

- R (Robotics): Collaborative robots, SCARA robots, parallel robots and mobile robots, etc.

- S (Safety): Safety light curtains, scanners, safety PLCs, safety door locks, safety switches and related components.

Beyond products, we offer application-specific solutions tailored to major industries—for example, EV battery manufacturing, packaging machinery, liquid transfer, and high-speed material handling. We also provide safety remediation services, which include machine audits, risk assessments and workforce training.

Additionally, our Data Management Services help customers visualise shop-floor performance through dashboards that enable OEE (Overall Equipment Effectiveness) analysis, downtime tracking and decision-making.

To deliver these capabilities effectively, we rely on a strong team of more than 100 application engineers across India. Their role is to understand customer challenges, design solutions and support implementation using OMRON technologies.

What is the significance of the new Bengaluru Automation Centre, which was opened in October 2025?

The Automation Centre is a key OMRON concept, and we now have ten such centres globally. Earlier, India’s centre was in Mumbai, but with growing market demand, Bengaluru—being a major manufacturing and technology hub—was chosen for a significantly larger facility.

The Centre is not intended to simply display products. It is designed around real-world manufacturing challenges. Through live demonstration systems, we show how automation can solve issues such as traceability, scratch defect detection, robotic pick-and-place, quality inspection, palletisation, PCB quality inspection, etc. It is far more effective than explaining solutions through presentations.

For customers, the Centre sparks new ideas and often reveals improvement opportunities they had not considered. Many visitors arrive with a specific requirement but discover additional solutions that can address other hidden inefficiencies. The Centre’s primary purpose is to promote collaborative problem-solving and inspire innovation among Indian manufacturers.

Which industrial sectors form your largest customer base?

Our business is fairly balanced across three major sectors: automotive, food and beverages (including pharmaceuticals), and infrastructure. We are also growing rapidly in digital industries and logistics automation.

How has the Indian manufacturing landscape changed in terms of automation over the last five years?

The last five years have brought two major shifts, both accelerated by the COVID-19 period.

From a manufacturer’s perspective, the pandemic exposed dependency on skilled human labour. Labour migration, absenteeism and skill shortages disrupted operations. Companies realised that automation is no longer optional—it is essential for resilience, consistency and business continuity. With manufacturing growing at a strong pace, competition for skilled workers has intensified. Manufacturers now recognise that deep, rapid adoption of automation is necessary to maintain productivity and meet market demand.

From a technology perspective, the biggest shift has been the integration of Artificial Intelligence (AI)—especially AI on the edge. Many of OMRON’s inspection systems now come with embedded AI, enabling tasks that were previously extremely difficult. For example, detecting minute scratches on shiny metal surfaces is now possible due to AI-powered vision with significantly reduced teaching times.

AI is also reducing dependency on highly skilled technicians. Earlier, retraining a PCB inspection system after design changes could take up to 90 minutes and required an expert operator. With AI-assisted systems, this can now be achieved in 5–10 minutes by a comparatively less skilled worker.

In short, AI is helping compensate for labour shortages, enhance quality and improve productivity.

How do you expect the manufacturing sector to evolve over the next five years?

The pace of transformation will continue to accelerate. Increased adoption of edge AI will make machines smarter and processes more autonomous.

Another major development will be the shift towards data-driven decision-making. Historically, data latency and system fragmentation prevented real-time analytics across multiple shop floors and geographies. This is changing rapidly.

OMRON has formed a strategic alliance with Cognizant to bridge OT and IT layers. OMRON’s DX1 and other controllers enable low-latency shop-floor data capture, while Cognizant is developing applications and dashboards that interpret this data. Together, this will empower leadership teams to make faster, more informed operational decisions.

How does India compare with other Asian countries in automation adoption? And which Indian industries lead or lag?

In discrete manufacturing, automotive and digital industries are the leading adopters, followed closely by food and beverages.

At a global level, India still has considerable ground to cover. For instance, although India is emerging as the fifth-largest market for industrial robots, our installed base is a fraction of countries like China, Japan and South Korea. We are progressing quickly, but the gap remains significant.

What barriers prevent wider adoption of automation, especially among MSMEs?

By one estimate, India has over six million micro, small and medium enterprises (MSMEs)—a staggering number. They play an essential role in the industrial supply chain, but many lack the resources and technical expertise required to adopt automation independently.

To address this, OMRON invests heavily in application engineering and in a strong network of over 130 channel partners. These partners provide local technical skills, implementation support and after-sales service, making automation more accessible for MSMEs.

Are MSMEs an important business segment for OMRON?

Absolutely. MSMEs already contribute 30–40 per cent of our business in India. Most machine builders are MSMEs, and they form a vital part of our customer base.

What major trends will influence manufacturing over the next few years?

At the shop-floor level, data visualisation will be a transformative trend. Manufacturers want real-time insight into performance, bottlenecks and downtime.

At the machine level, quality and safety will see accelerated focus. Customers increasingly demand higher-quality output and safer operations, and automation technologies will play a central role in achieving both.

How do you view the growth of robots and cobots in India?

Growth has been strong, but both robots and cobots have specific application niches. Cobots are best suited for tasks involving safe human–robot interaction. For processes such as welding, where human presence is not feasible, industrial robots remain the preferred choice.

What is your long-term growth vision for OMRON’s FA business in India?

We aim to sustain our long-term CAGR of around 15 per cent, while strengthening our role as an enabler of India’s manufacturing excellence. Our larger purpose is to help Indian manufacturers match—and surpass—their global counterparts in automation maturity, quality and competitiveness.

Related Stories

India is at a pivotal ‘Make in India’ inflection point: Manoj Patil

In this interview, Manoj Patil, Promoter and Managing Director, Patil Automation Limited, outlines its growth journey, capacity expansion, acquisitions, design-led approach, market challenges, and t..

Read more

Gandhi Automations Redefines Loading Bay Safety with Dock Levelers

Gandhi Automations strengthens loading bay efficiency with EN-compliant dock leveler solutions.

Read more

Manufacturing Excellence in the Age of Integrated Automation and Industry 4.0

Manufacturing leadership is shifting from scale-driven efficiency to integrated, data-led systems that deliver resilience, sustainability and enterprise-wide performance through Industry 4.0 and aut..

Read moreRelated Products

Digimatic Smart Caliper

Veekay Industries offers a wide range of digimatic smart caliper.

Compact Fmc - Motorum 3048tg With Fs2512

Meiban Engineering Technologies Pvt Ltd offers a wide range of Compact FMC - Motorum 3048TG with FS2512.

Digital Colony Counter

Rising Sun Enterprises supplies digital colony counter.