Schedule a Call Back

Equipment / Machinery Finance for SMEs

Equipment / Machinery Finance for SMEs

Capital SolutionsSM offers Equipment/Machinery Finance for SMEs. The company is a team of qualified professionals providing customised solutions to Small and Medium Enterprises (SMEs) at different levels of growth. With strong relationships in banks and institutions, it provides an excellent choice to companies looking for equipment/machinery loans in aggressive time frame. Equipment finance provides convenient and hassle-free funds to procure the equipment/machinery that helps a business grow, be it technology up-gradation, capacity expansion, diversification, etc.

Types of equipments:

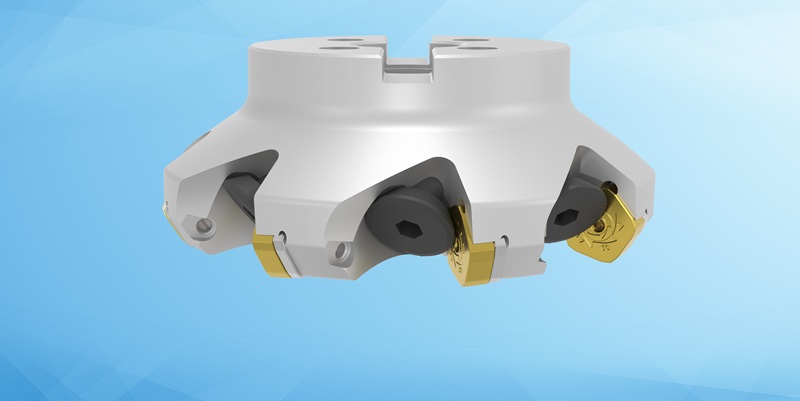

- Industrial equipment/machinery

- IT equipment

- Medical equipment and much more

The minimum loan amount is Rs 25 lakh.

Advantages of equipment/machinery term loan:

- For standard equipment/machinery, no additional security required as finance is against equipment purchased

- Helps preserve working capital and bank lines of credit

- Monthly repayments can be scheduled based on cash flows or product cycle

- Competitive rates

Product & Technology News

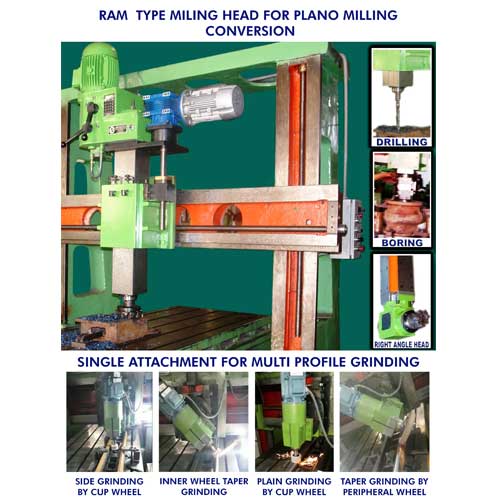

Products from MACHINE TOOLS, POWER & HAND TOOLS Category

Versatile Machining Capability Through Ram Type Milling & Grinding Heads