Schedule a Call Back

Lip-Bu Tan to be advisor for Yali Capital; India’s first deep-tech venture fund

Industry News

Industry News- Jul 16,24

Related Stories

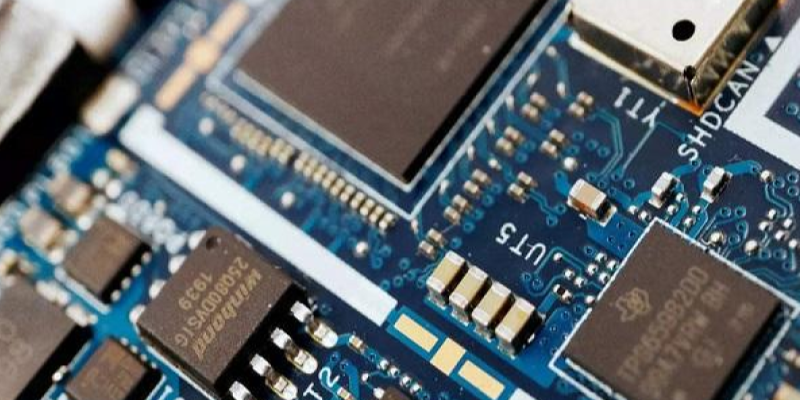

Intel may split chip design and manufacturing businesses due to loss

The company reported a net loss of $1.61 billion in the second quarter of 2024, leading to a 26% drop in its stock price—the worst single-day performance in over 50 years.

Read more

Centre unveils $15 billion blueprint to establish India as a major chip hub

As part of the new blueprint, the government plans to reduce the capital expenditure subsidy for assembly and testing plants (ATMP/OSAT) from the current 50% to 30% for conventional packaging techno..

Read more

93% of big companies see AI equal to success, yet struggle with talent shortages

Diversity within AI teams also emerged as a concern, with 80% of respondents emphasising its importance.

Read moreRelated Products

78 Series Din Rail Terminal Blocks

Werner Electric Private Limited offers a wide range of 78 series din rail terminal blocks.

Mig Welding Torches

ATE Welding Engineering Robotics & Automation offers MIG welding torches. Read more

Puma Lift Electric Stacker

Puma Lift Trucks Pvt Ltd offers a wide range of puma lift

electric stacker.